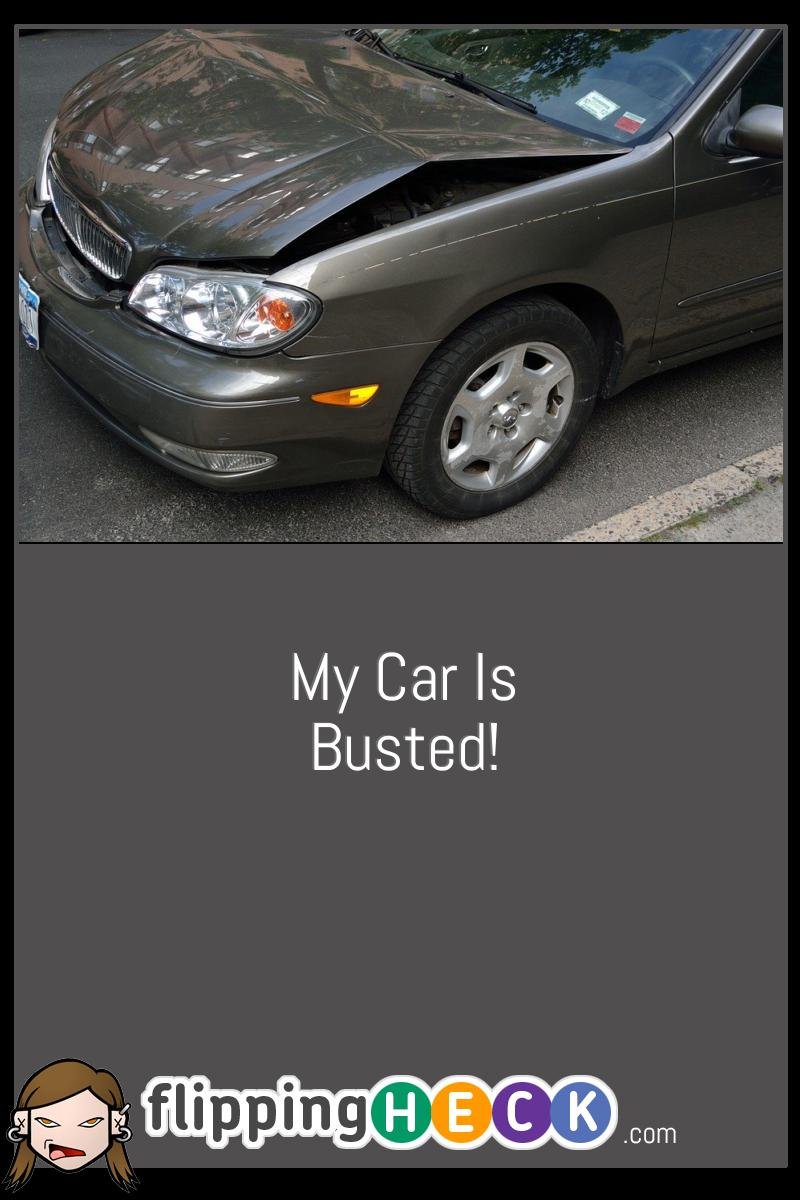

My Car Is Busted!

You’d be surprised to know that most car owners consider a loan when their cars need immediate repair works. However, more often than not, you don’t need to add a last-minute loan to your credit score. Ultimately, chances are that loans taken in a hurry can affect your credit history and also lead to financial issues, as you’re at risk of signing for a bad deal to save time. Before you rush to a loan broker, here are the things you want to consider.

Ah, cars! We need them in our everyday life. They are an indispensable tool of our lifestyle. Unfortunately, despite using them every day, most of us are unable to figure out the most effective approach when our beloved vehicle stops working.

Typically, your car will show signs of wear and tear, which you can address over time with trusted mechanics. However, if your vehicle gets damaged, such as being involved in a collision, there’s no time for you to adjust. When your car is busted, you need a quick and cost-effective solution to address the issue.

You’d be surprised to know that most car owners consider a loan when their cars need immediate repair works. However, more often than not, you don’t need to add a last-minute loan to your credit score. Ultimately, chances are that loans taken in a hurry can affect your credit history and also lead to financial issues, as you’re at risk of signing for a bad deal to save time. Before you rush to a loan broker, here are the things you want to consider:

Can it be fixed?

Body damage is one of the most common issues after a car collision. As a driver, the sound of crushed metal can be alarming. However, more often than not, things sound and look a lot worse than they are. Indeed, you’ll be pleased to know that you can fix a lot of collision dents and body issues yourself if you’ve got the right tools.

Alternatively, if you’re not sure how to approach the problem, it’s a good idea to check on Google Maps for local car body works experts. You can find reliable and trustworthy professionals who can not only quote body work repairs for you but who are also authorized by car insurance to work on their clients’ vehicles.

You can have a check with them to find out, firstly if your car can be fixed, and secondly how much it would cost – you might also consider adding some additional car modifications while you’re going about this.

Find someone to fight for your rights

If you have been involved in a road accident, it’s essential to know and understand your rights. You can find car accident lawyers who prioritize client satisfaction and who can help you to get compensation for your injuries and other expenses related to the crash – which means you can also discuss car costs. Admittedly, if you haven’t sustained any personal injury in the collision, you can handle the situation directly with your car insurer, whose focus is on the vehicle first.

You will need to buy a new vehicle

When your car has been wrecked in an accident, you have no other choice than to consider purchasing a vehicle. Your car insurance can cover the partial loss of the vehicle. Without GAP insurance protection, you might find yourself out of pocket to buy a new vehicle!

When shopping around for a vehicle, don’t be afraid to purchase a car at the best deal, even if the dealership is at the other end of the country! You can find a dedicated auto transport company to help you relocate your vehicle while still saving a lot of money in the process.

Should you take a car loan to replace a damaged vehicle? The answer is no. You can avoid a last-minute loan by focusing on your repair works, your rights, and your car value protection. Always do your research to keep your car costs low!